With the greatest experience of schools’ mutuals, the most developed statistical methods and software and the least overheads of any operator, see how a miniMAX mutual can offer you the best solution to your staff absence cost mitigation headaches, whilst giving you the widest choice of options and benefits.

Lowest Cost

On Like-for-like Basis

Improved Cashflow

Keeping more money in schools’ pockets for longer

Proven Over 20+ Years

Customers have been using our schemes since 2004

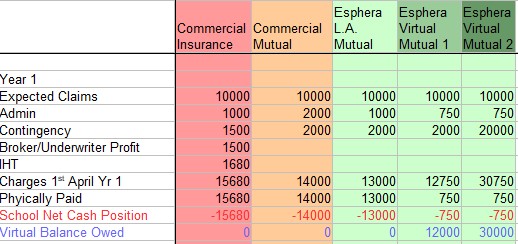

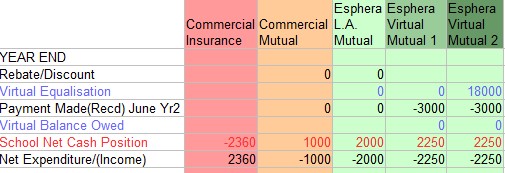

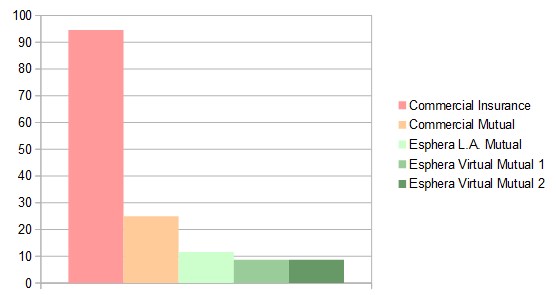

Comparison of Options – Typical Example

For this simple example we have taken a scheme with 3 schools, all of whom we expect to claim £10000 per year and shown how they perform in each of 5 scenarios.

- Under a conventional commercial insurance arrangement

- Under a typical commercial mutual

- Under a Esphera powered Local Authority mutual scheme

- Under an Esphera miniMAX Virtual Mutual with lower contingency

- Under an Esphera miniMAX Virtual Mutual with higher contingency

One school has very low claims, one has just below average and the other higher than average claims. We are going to explain what happens in each scenario for each school to demonstrate 2 things.

- Why a mutual is better than insurance

- How an Esphera mutual outperforms any other mutual.

Scenario

For any given set of benefits, no matter who the organiser is the expected claims for each school will be the same but different insurances/schemes/funds will apply different overheads and methods

- All options require an Admin charge to operate the scheme

- All options apply a contingency to cater for margins of error in calculations/volatility in absences

- Insurance has to add for Broker/Underwriter profit and Insurance Premium Tax

- Conventional options require all this paid upfront, Esphera Virtual Mutual schemes just require the admin fee, the “virtual contribution” is just held as a virtual balance.

Each school claims multiple times through out the year (in our example 3 times)

- The low claiming school claims very little in comparison to the expected claims amount

- The average claiming school claims just under the expected claims amount

- The high claiming school claims above the expected claims amount

Pre Cover Period

Low Claiming School – in the virtual mutuals initial costs are a fraction of conventional options

Average Claiming School – in the virtual mutuals initial costs are a fraction of conventional options

Higher Claiming School – in the virtual mutuals initial costs are a fraction of conventional options

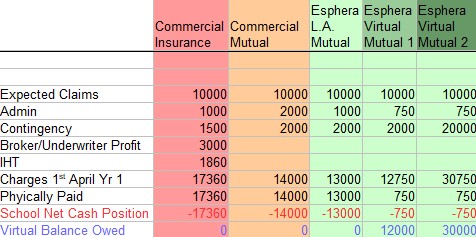

Absence/Claim Period

Low Claiming School – school has multiple claims through period totalling £1900. With conventional insurance and mutuals school receives money back, with the virtual mutuals the virtual balance is reduced and no money actually moves.

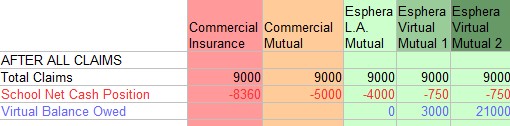

Average Claiming School – school has multiple claims through period totalling £9000. With conventional insurance and mutuals school receives money back, with the virtual mutuals the virtual balance is reduced and no money actually moves.

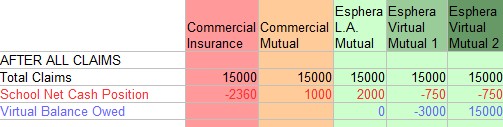

Higher Claiming School – school has multiple claims through period totalling £15000. With conventional insurance and mutuals school receives money back, with the virtual mutuals the virtual balance is reduced and no money actually moves.

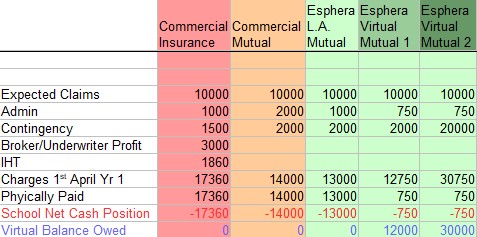

Year End Adjustments and Payments

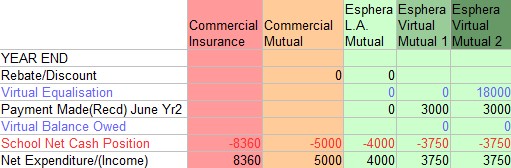

Low Claiming School

Average Claiming School

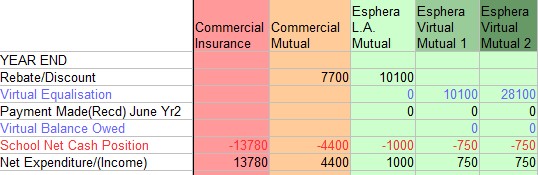

Higher Claiming School

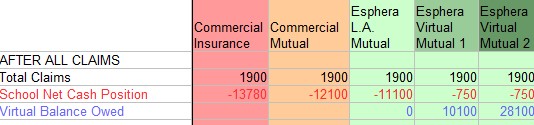

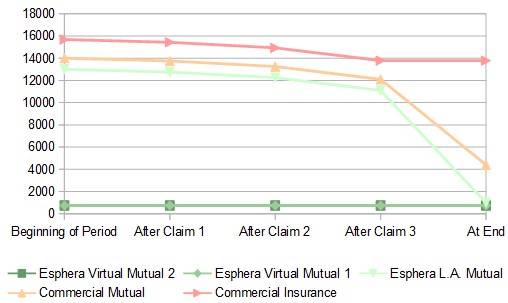

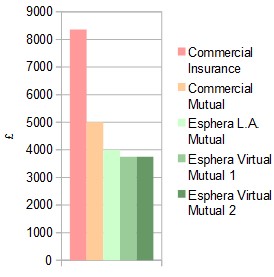

Cash Flow: Out of Pocket Position

Low Claiming School

making 3 claims of £250, £500 and £1150 totalling £1900

Insurance: Constantly out of pocket and greatest end cost.

Commercial Mutual: Out of Pocket for most of year then recoups with mutual adjustments.

Esphera Mutual: Lowest out of pocket and lowest net cost – virtual mutuals have minimal loss of cash throughout the year. At year-end in the miniMAX mutuals, payments and claims are evaluated (this school has a virtual balance of £10100(12000-1900)/£28100(30000-1900) owing), equalisation credits are applied (based on overall virtual surplus of £10100/£28100) and it is determined that no further funds are required from the low claiming school.

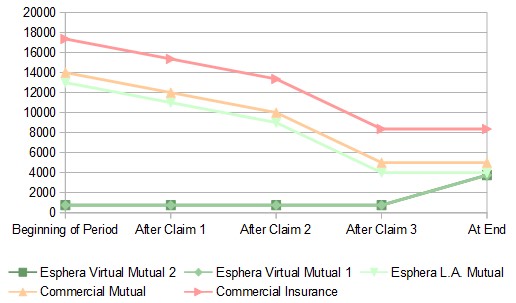

Average Claiming School

making 3 claims of £2000, £2000 and £5000 totalling £9000

Insurance: Constantly out of pocket and greatest end cost.

Commercial Mutual: Out of Pocket for most of year then recoups with mutual adjustments.

Esphera Mutual: Lowest out of pocket and lowest net cost – virtual mutuals have minimal loss of cash throughout the year. At year-end in the miniMAX mutual, payments and claims are evaluated (this school has a virtual balance of £3000(12000-9000)/£21000(30000-9000) owing), equalisation credits are applied (£0/£18000) and it is determined that the average school needs to pay the high claiming school £3000.

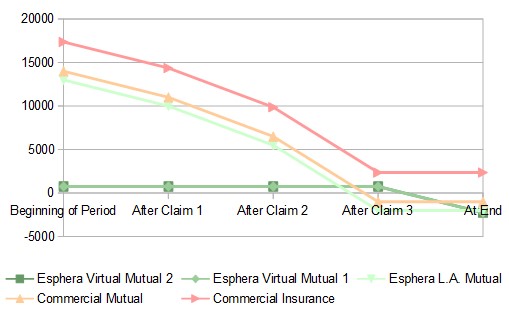

Higher Claiming School

making 3 claims of £3000, £4500 and £7500 totalling £15000

Insurance: Constantly out of pocket and greatest end cost.

Commercial Mutual: Out of Pocket for most of year then recoups with mutual adjustments.

Esphera Mutual: Lowest out of pocket and best level of payback – virtual mutuals have minimal loss of cash throughout the year. At year-end in the miniMAX mutual, payments and claims are evaluated (this school has a virtual balance of -£3000(12000-15000)/£15000(30000-15000) owing), equalisation credits are applied (£0/£18000) and it is determined that the high claiming school receives £3000 from the average claiming school.

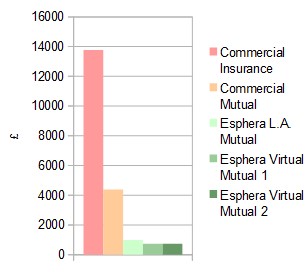

Net Cost

Low Claiming School

For low claiming schools commercial insurance is prohibitively expensive, commercial mutuals are much better because they allow some redistribution to offset the low claims but the Esphera mutual schemes are a fraction of the cost due to the Equaliser process at the end of the year ensuring a good (low level) absence experience doesn’t translate into a bad cost experience.

Average Claiming School

For average claiming schools commercial insurance is the most expensive, commercial mutuals are better because they allow some redistribution to offset the claims but the Esphera mutual schemes are still the most cost effective due to being optimised across all schools.

Higher Claiming School

For high claiming schools commercial insurance still costs the schools money even though the claims are much higher than anticipated which is why the red bar is above the zero line. Schemes with bars below the line are receiving a positive cash benefit. Commercial mutuals are much better as they have paid out significantly more than has been paid by the schools but the Esphera mutual schemes still return more money to schools due to the methodology employed which means that contribution levels (real and virtual) are more finely tuned and the Equaliser helps ensure the best outcome.

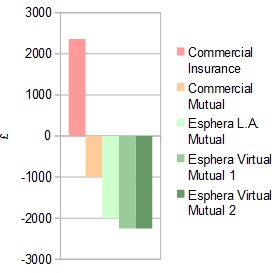

Scheme Overall

Net Cost

Esphera miniMAX mutuals significantly the lowest cost option.

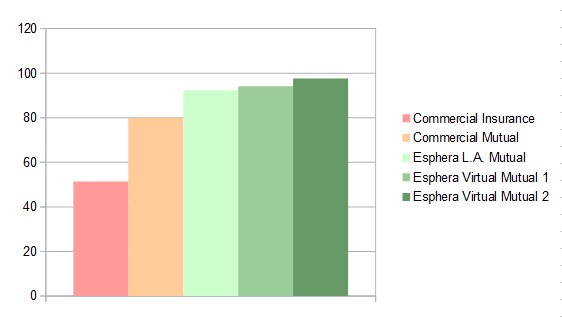

Efficiency (The amount of money paid out that is received back)

Esphera miniMAX mutuals are the most efficient with >90% of funds returned to schools.

Net Cost % of Claims (The amount of money spent as a percentage of the total value of claims)

Esphera miniMAX mutuals significantly the lowest cost as a proportion of schools’ claims (this is the fairest way to compare apples with apples, taking a percentage of premium/contribution distorts the true picture).

Summary

- All mutual schemes provide a better outcome for schools than insurance (unless operators are inexperienced or incorrectly motivated).

- In the conventional schemes there would be 12 payments back and forth (3 initial payments and 9 claim payments) , in the virtual mutual there were just 4 (3 initial payments and 1 year-end payment)

- In every case whether you experience low, average or high absences you will be better off (lower net costs and higher efficiency across the board) in an Esphera mutual (a local authority one if they offer one or in a miniMAX mutual if they do not).

- In an Esphera mutual the average claiming school had approximately 4.5 times the claims value of the low claiming school and it’s net costs were approximately 4.5 times irrespective of the initial virtual contribution, thus keeping everything fair. The high claiming school had a net gain as its claims were exceptionally high, so the extra costs of absence have been minimised.

- In an Esphera miniMAX Virtual Mutual the amount used as your initial virtual contribution doesn’t matter, you end up paying (or receiving) the same as for every £ under or over the post-period equalised amount, it is “equalised” back at year end.

- Other commercial mutual schemes ultimately cost approximately 3 times as much as an Esphera powered mutual scheme. Our extensively developed software, methodology and online processing ensures minimal overheads which ultimately dictates the cost effectiveness of our schemes.

- In the miniMAX Virtual Mutual, efficiency will vary year to year as the absence experience varies but the Equaliser year-end process constantly moves schools towards the overall 92.5% efficiency. Therefore the longer schools are in the scheme the closer they will be to that 92.5% which means that the sooner you join the sooner you will benefit.

- With the miniMAX Virtual Mutual the gamble of what to choose has been removed, if you have high claims you will be reimbursed according to the benefit levels chosen and if you have low claims you will get sufficient equalisation to minimise your net costs more than any other option.

- If you can see the clear benefits of Esphera’s miniMAX Virtual Mutual and would like to participate from April 2025 please complete the Expression of Interest Form Here